In their review of Riksbank monetary policy, Goodfriend and King make a big point of the minority (Karolina Ekholm and me) having voted for policy rates only 0.25 percentage point below the majority and use that to argue that the rate hikes 2010-2011 were “broadly accepted by all members of Executive Board.” But they fail to report that the monetary policy stance, appropriately measured, that the minority voted for was substantially more expansionary than the majority’s (not to speak of that it was only a first step of several needed in a move toward a better monetary policy). They thus fail to report the position of the minority correctly. For instance, in September 2011, the minority voted for a policy stance equivalent to a repo rate 1.5 percentage point lower the next 4 quarters than the majority’s stance.

At one meeting, September 2011, we even voted for the same policy rate as the majority, 2%, something that King emphasized at the press conference where the review was presented. However, even that did not mean that we “broadly accepted” the monetary policy stance of the majority. The monetary policy stance we voted for was actually substantially more expansionary than the majority’s, something Goodfriend and King have chosen not to report (or perhaps not understood).

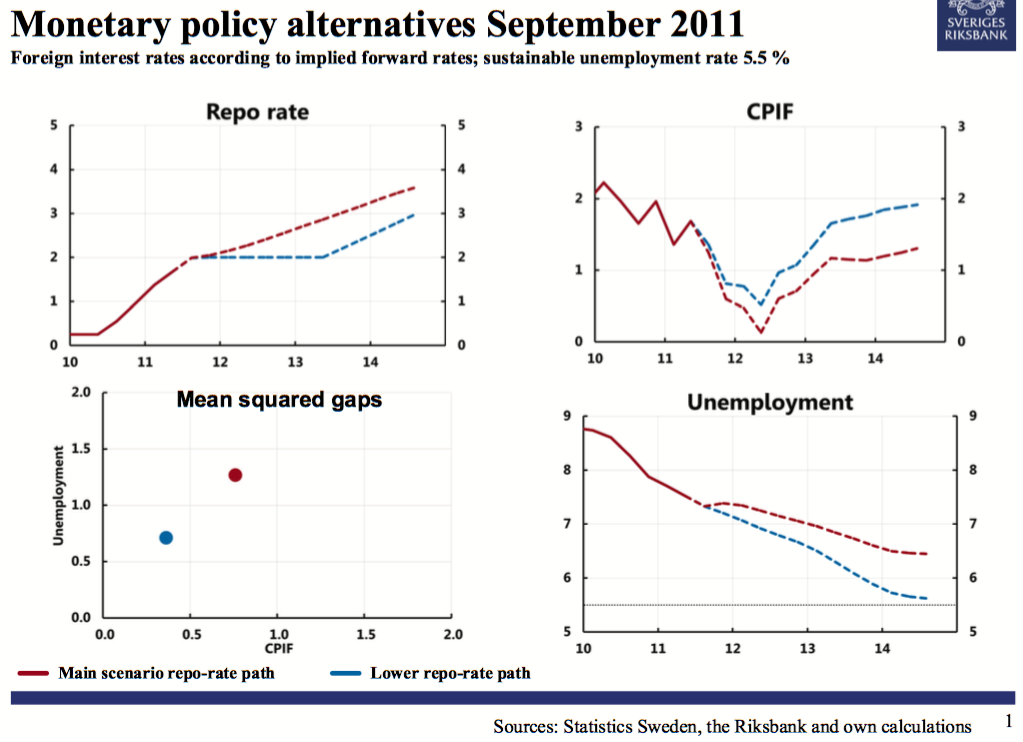

Figure 1. Monetary policy alternatives in September 2011. Source: Minutes from the Riksbank policy meeting, September 2011.

Figure 1 shows the majority (Main Scenario) repo-rate path (red) and the lower one we voted for (blue). (The figure was brought by me to the meeting and is included in the minutes. Similar figures for other meetings are available here.) It also shows forecasts for inflation and unemployment conditional on the two repo-rate paths. (These forecasts are conditioned on a forecast of foreign interest rates equal to market expectations. This removes an upward bias for inflation and downward bias for unemployment in the majority’s forecasts caused by the majority’s assumption of a much higher forecast of foreign interest rates. This bias of the majority forecasts is criticized by Goodfriend and King after 2011 (p. 84, pp. 87-88), but it was equally present during 2010-2011.)

Appropriately measured, a substantially more expansionary monetary policy stance

At the Riksbank, since February 2007, board members have voted for both a current repo-rate and a repo-rate path with a horizon of three years. This means that the monetary policy stance a board member votes for is given by the whole path, not just by the current policy rate as Goodfriend and King seem to mean. The appropriate measure of the policy stance is then the average repo rate over the three-year horizon, not the current repo rate. Such an average over three years can be seen as equivalent to a 3-year interest rate.[1]

In this case, the average repo rate over the three years is about 2.75% for the majority repo-rate path and about 2.25% for the minority path, a difference of about 0.5 percentage points. Thus, the policy stance the minority voted for implied a 0.5 percentage point lower 3-year interest rate. This is a substantially more expansionary policy stance. It is equivalent to a full 1.5 percentage point lower repo-rate during one year (which gives the same 3-year average of 0.5 percentage points). Thus, compared to the majority policy stance, the minority policy stance corresponds to a 1.5 percentage point lower repo rate during one year. This one-year equivalent of the minority repo-rate path is shown as the green dashed line in figure 2. This is hardly consistent with the minority “broadly accepting” the majority’s policy.[2]

Figure 2. The majority’s policy-rate path (red) and the one-year equivalent of the minority’s path (green)

And only a first step

Furthermore, as explained in more detail here and here, this was only a first step, not a complete step. As can be seen in the figure above, the blue inflation and unemployment forecasts conditional on the lower repo-rate path bring substantially better target achievement than than the red forecasts conditional on the majority path.[3] But the blue inflation forecast is still lower than the inflation target, and the blue unemployment forecast is still higher than a long-run sustainable unemployment rate.

So even if our first step would have been taken at this meeting, at the next meeting, with new forecasts and new simulations, a second step down, with a lower current repo rate and lower repo-rate path, would have been justified. Following the principle “adjust policy until the forecasts of inflation and unemployment look good” this would have gone on for a few meetings, until the forecasts did “look good”, meaning that they best stabilized inflation around the target and unemployment around its long-run sustainable rate. Unfortunately, the majority did not allow as to take even the first step.

Why couldn’t this be done in one single big step to the optimal repo rate and repo-rate path? This was because of technical limitations in the methods available at the Riksbank to calculate alternative policy-rate paths and corresponding inflation and unemployment forecasts. The methods only allowed relatively moderate variations from the Main Scenario, that is, the majority’s policy-rate path and forecasts. The difference between the alternative and main repo-rate paths above was about how much the methods could handle.

Majority policy not “broadly accepted” and minority position not correctly reported

So, in summary, even if we voted for a moderately lower current repo rate (and on one occasion for the same repo rate), given that our repo-rate paths were substantially lower, our overall monetary policy stance was substantially more expansionary than the majority’s. And it was only a first step to a better monetary policy. So the majority policy was not “broadly accepted” by us. Goodfriend and King fail to report the position of the minority correctly.

[1] If market expectations of future repo rates would equal the repo-rate path, the average repo-rate would equal a 3-year bond rate less the average term premium. For an unchanged average term premium, a given repo-rate path thus corresponds to an intended 3-year interest rate equal to the average repo-rate plus a constant.

[2] Furthermore, this is a lower bound of difference between the majority and minority policy stance. It disregards the difference in the repo-rate paths beyond the 3-year horizon. If that is taken into account, the difference, expressed in a 1-year equivalent repo-rate change, is even larger than 1.5 percentage points.

[3] The bottom-left panel shows mean squared gaps between forecasts of inflation and unemployment and, respectively, the inflation target(2%) and the long-run sustainable rate (5.5%, my own estimate at the time). Clearly the low repo-rate path dominates.