“Is Swedish Household Debt Too High? Solvency, Liquidity, and Debt-Financed Overconsumption,” first draft July 2022, revised November 2025.

Paper (latest version). CEPR Discussion Paper. NBER Working Paper.

Ekonomistas blog post, November 17, 2025: “Svenska hushålls skulder är inte för höga: Se på soliditet och likviditet, inte skuldkvoten”

VoxEU column, November 11, 2025: “Swedish household debt is not too high: Look at solvency and liquidity, not debt to income”

Op-ed in Dagens Nyheter, DN Debatt, November 26, 2024: “Bolånen är varken för höga eller ett hot mot stabiliteten” [“Mortgages are neither too high nor a threat to stability”]

Ekonomistas blog post, November 26, 2024.

Abstract

Swedish authorities and international organizations that monitor and comment on Swedish economic policy have argued that Swedish household debt is too high and a threat to financial and macroeconomic stability (FMS). But household debt may become a threat to FMS under essentially three conditions: (1) Household debt becomes too high relative to household assets; houeholds’ solvency becomes too low. (2) Households’ debt service becomes too high relative to incomes and payment capacity; households’ liquidity becomes too low. (3) Households use home-equity withdrawals—made possible by rising house prices—to finance an unsustainable overconsumption of macroeconomic significance.

The analysis covers both the total stock of mortgages and its borrowers and the new mortgages and borrowers, not—as is common—only the new mortgages and borrowers. The total stock is much larger, its borrowers are many more, and they matter much more for FMS.

Two structural features mitigate risks from the Swedish household debt. First, on a closer look, mortgages are in fact a safe cash cow for banks and contribute to financial stability. Second, the mortgage rates are not exogenous but indirectly controlled by the Riksbank and its policy rate. The Riksbank sets the policy rate to maintain macro\-economic stability and contribute to financial stability.

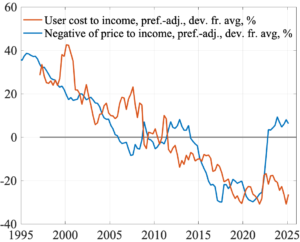

Regarding condition (1), aggregate household assets are much larger and have grown much faster than the debt. Net wealth was twice the debt in 1985, five times the debt in 2024. LTV ratios among the borrowers of the mortage stock are much smaller than those among the new borrowers. A full 78% of the borrowers of the stock have home equity exceeding 30%, which is more than any housing price fall during the last 50 years. The borrowers of the stock are sufficiently solvent. Regarding condition (2), the debt service of the borrowers of the stock is not high relative to incomes, because modest LTV ratios mean that required amortization rates are modest. The borrowers of the stock are sufficiently liquid. Regarding condition (3), there is no indication that there is any debt-financed overconsumption (undersaving) of macro-economic significance. The HEW recorded by the Swedish FSA is not unusually high, the saving rate is at a historical high, and the share of durable consumption in total consumption expenditures is normal.

Thus, none of the three conditions is present. The borrowers of the mortage stock are sufficiently solvent and liquid, and they do not overconsume. Swedish household debt is neither too high nor a threat to financial or macroeconomic stability.